gordonliddy

Bluelighter

Is what starting to happen?

I'm of the opinion that the commercial real estate market in big cities is due for a correction.

"Work from home" technology has been here since the 90's, but management of that era was certainly not behind it. Then COVID happened, and the Western World basically ran itself remotely for a couple of years. So the work remote thing is no longer a hypothetical, it's a validated business model.

When the correction in commercial real estate happens, how far will it fall? And will it come back in the next two decades. Possibly it won't. My thoughts are that if it falls hard enough, then a lot of those buildings simply get retrofitted for residential.

...but if there are no office buildings any more, won't some amount of the residential demand subside since....you don't need the servant class for the office crowd anymore. You don't need commercial real estate janitors. You don't need the workers who prepare lunches for office people. And so on and so forth.

I'm not predicting a catastrophe, I'm predicting a correction. I'd have to assume that profit taking will take place in tech. Almost certainly in pharma.

Anyways, that's my model. I'm predicting that it's commercial real estate defaults that will trigger commercial to crash. Commercial will lead the crash.

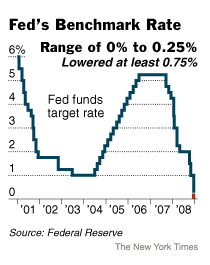

Remember that time that the Francis Key Bridge got smashed, and the market kept right on chugging? Or how about the time that Israel caught a massive terror attack, and the market kept chugging? So what will be the catalyst for the next correction? I'm thinking it will be real estate. Remember sub prime?

This could be offset I think in that the two things that would pump the market a lot would be if Trump wins, or if the Ukraine war ends. But aren't both of those pretty much the same thing? Kind of an inevitability by this point, but we need to wait until November.

This is all a wild theory. I'd LOVE your input.