Thomas Davie

Bluelight Crew

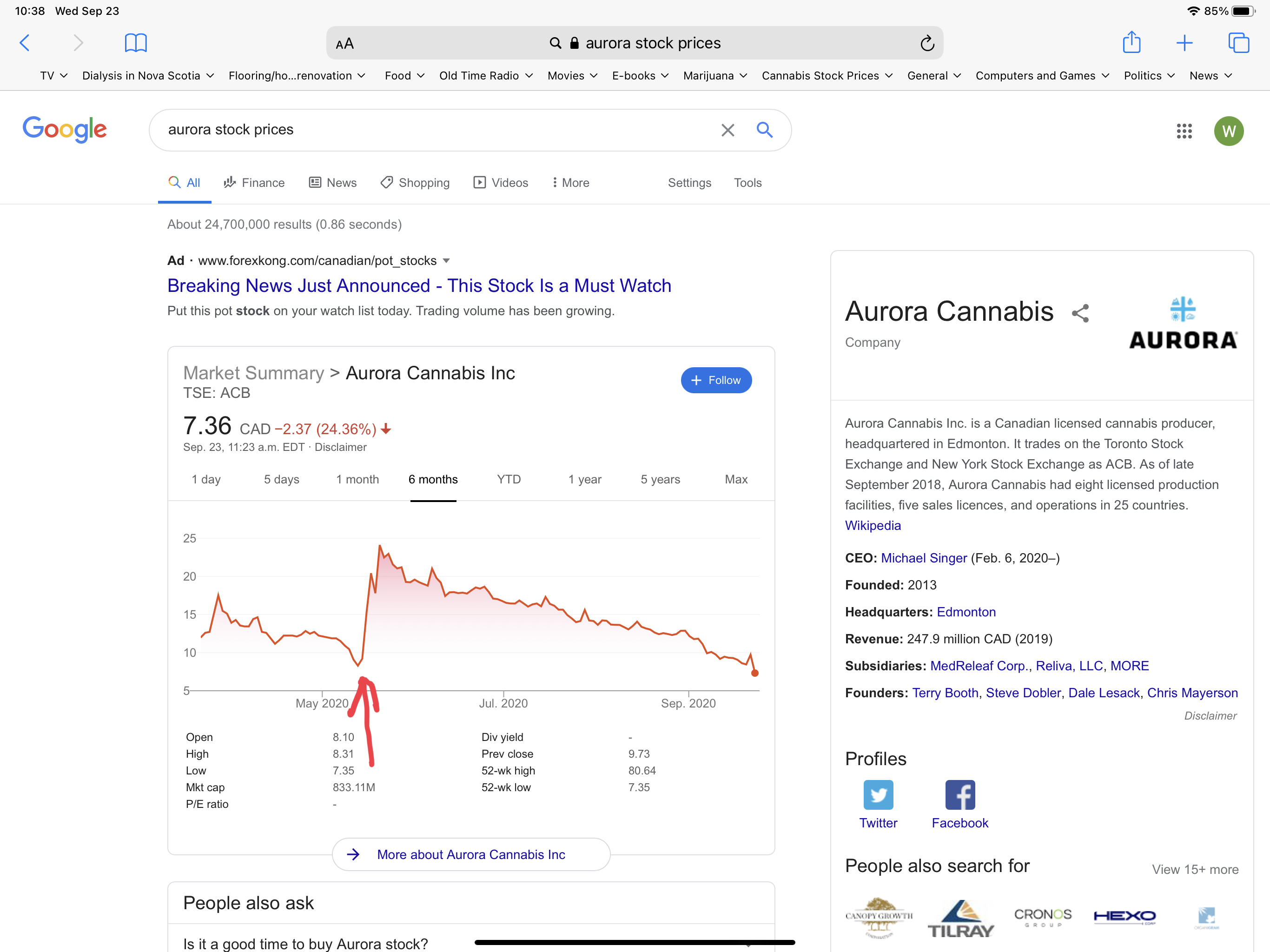

First off, Aurora managed a reverse stock split back in late May. The definition of a reverse stock split is

A reverse stock split is a type of corporate action which consolidates the number of existing shares of stock into fewer, proportionally more valuable, shares. The process involves a company reducing the total number of its outstanding shares in the open market, and often signals a company in distress.

A reverse stock split divides the existing total quantity of shares by a number such as five or ten, which would then be called a 1-for-5 or 1-for-10 reverse split, respectively. A reverse stock split is also known as a stock consolidation, stock merge or share rollback and is the opposite exercise of stock split, where a share is divided (split) into multiple parts.

Here is a look at the performance of Aurora’s stock since May.

On the chart, you can see where the reverse stock split was initiated and you can see how little effect this has had.

Tom

Forgot to add that this was a 1 for 12 split.

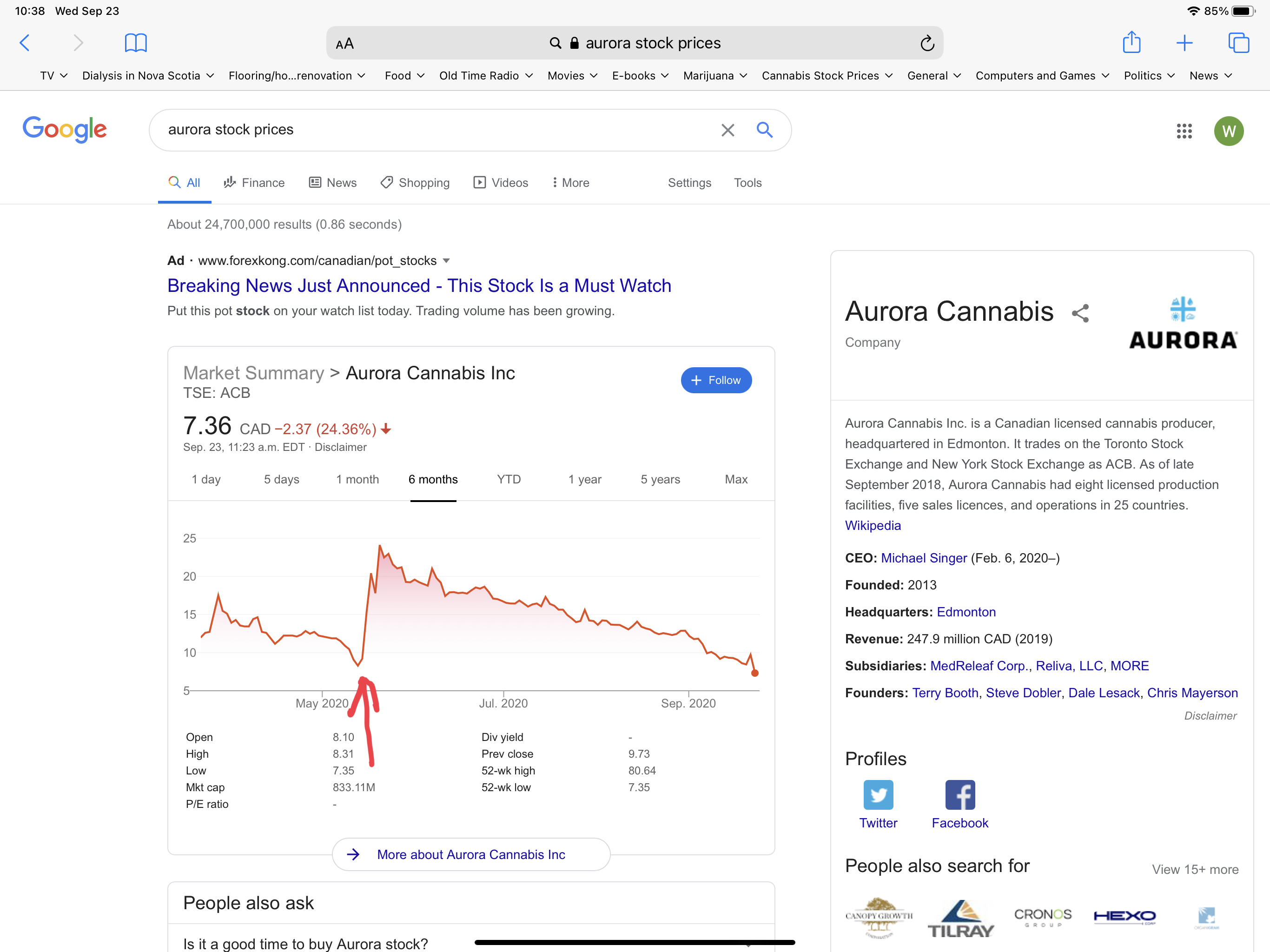

A reverse stock split is a type of corporate action which consolidates the number of existing shares of stock into fewer, proportionally more valuable, shares. The process involves a company reducing the total number of its outstanding shares in the open market, and often signals a company in distress.

A reverse stock split divides the existing total quantity of shares by a number such as five or ten, which would then be called a 1-for-5 or 1-for-10 reverse split, respectively. A reverse stock split is also known as a stock consolidation, stock merge or share rollback and is the opposite exercise of stock split, where a share is divided (split) into multiple parts.

Here is a look at the performance of Aurora’s stock since May.

On the chart, you can see where the reverse stock split was initiated and you can see how little effect this has had.

Tom

Forgot to add that this was a 1 for 12 split.